June 25, 2015

By: Diane Kennedy, CPA

There are a lot of good reasons for setting up a foreign LLC. You’ll have some hoops to jump through, paperwork to complete and there are obviously fees you’ll pay to get it done. And then, you transfer your pension or your money and you’re done, right? No!

There are a lot of good reasons for setting up a foreign LLC. You’ll have some hoops to jump through, paperwork to complete and there are obviously fees you’ll pay to get it done. And then, you transfer your pension or your money and you’re done, right? No!

You have 75 days after you set up a foreign LLC to tell the IRS how you want to have it taxed. In the US, when you set up an LLC, there is a default to a flow-through entity if you don’t tell the IRS. For example, a single member LLC in the US would be treated like a regular Schedule C Sole Proprietorship or a Schedule E rental. A multi-member LLC defaults to a partnership.

The exact opposite is true if you have a foreign LLC. If you don’t elect to be treated as a flow-through entity, you will be taxed like a foreign corporation. You have 75 days to tell the IRS with Form 8832 that you don’t want to be taxed as a corporation.

If you miss the deadline, it may be possible to file for a late election, but you’ll need to get an experienced CPA or tax attorney to help you with that filing.

That isn’t the end of your US filing. If you have a single member foreign LLC that is taxed as a flow-through entity, you also need to file Form 8858 each year. If the foreign LLC is taxed like a foreign corporation you need to file Form 5471 each year. If the foreign LLC is taxed like a foreign partnership, one or more partners will need to file Form 8865 each year.

If you move money over to a foreign corporation or trust, you also need to file Form 926 for the year when you do it.

And each year, you’ll need to file a FinCen 114 if you have over $10,000 aggregate at any time in foreign investments or bank accounts that you own, have signature authority on or are a beneficiary on. The FinCen 114 needs to be filed online with the Treasury Dept by June 30th. There is no possible extension.

Failure to file the required forms can mean penalties of 50% or more of the balances.

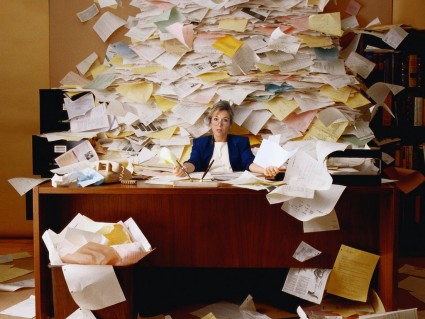

If your head is spinning a little from all the forms and requirements, it’s perfectly normal. Just make sure you have a qualified and experienced US tax professional on your team as soon as you set up your entity. If you miss the initial filing deadlines, it gets more complicated and expensive.

You can find Diane Kennedy, author of “The Offshore Tax Guide” at www.USTaxAid.com.