June 23, 2014

By: Kelly Diamond, Publisher

There’s been a fair amount of grumbling over the past several months regarding the IRS and its dealings with some “Conservative” groups.

There’s been a fair amount of grumbling over the past several months regarding the IRS and its dealings with some “Conservative” groups.

It started off as there being a good amount of stalling and balking when some “conservative” groups filed for tax-exemption status with the IRS. About 25% of them were “stalled” or denied in some way. Given the average amount of time it takes to process the application and the general guidelines and standards for getting tax exemption status, there was no excuse for delaying their applications.

I wrote about this in my “War on Dissenters” piece over a year ago. At the time they were just STARTING this investigation. Since then, Lois Lerner has since been relieved on her duties and held in contempt of court for refusing to testify.

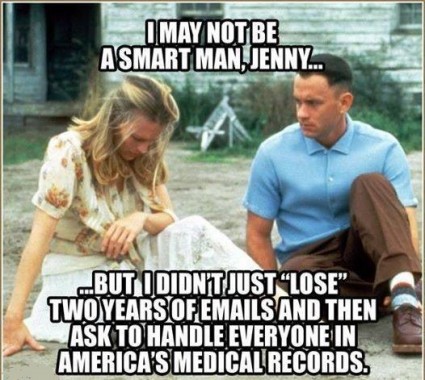

Now, it would appear, that two year’s worth of emails have been “lost”. It’s so hard to take such a claim seriously, especially from the IRS. This is the same IRS I’d discussed in “IRS = Government Stalkers” that has been probing, prying, issuing “John Doe” Summonses, and compiling people’s “financial DNA” profiles. These guys. THEY lost two whole years of email correspondence? And they noticed this while they happened to be on trial for some sort of scandal?

Okay. Let me just suspend my total disbelief for a second. For as much data as the IRS happens to be compiling and collecting on the goings of people, you would think that MAYBE they would back up their data? I back up my paltry amount of stuff on an external drive and cloud service. You never know. So is it possible that I am more responsible for my data than the IRS is of theirs?

As it turns out, there was a “private” company that was providing back up service for the IRS’ emails: Sonasoft. According to Reason.com, these guys have been doing business since at least 2005. Albeit, the amount of business has been rather small (i.e. in the tens of thousands), the extent to which IRS emails have been backed up is still unknown.

I’m not hearing about probes into this company and what it has stored for the IRS to date, however. In fact, I’m only hearing excuses.

Now, imagine for just a second, what would happen if WE did this to the IRS. IRS audits you and asks for receipts, filings, documents, statements, etc. to corroborate your claims in past years, and you say… “I lost it.” Well, you’re guilty until proven innocent then! Whereas the IRS is innocent until proven guilty beyond a scientific doubt, you’re presumed guilty and will pay the maximum of the charges leveled against you. I’m no tax lawyer, but you’re either going to pay up to the IRS, pay up to a really good defense, or to both if you don’t have all your I’s dotted and your T’s crossed.

While I realize that this is the longest shot ever, there was a resolution put forth by a Texas representative, Steve Stockman, to make it legal to do just that! The sad part is that you need a law to be passed to get away with the crap that government does on a rather regular basis. The cool part is that this guy is willing to call it out on the House floor.

Check out some of the viable excuses for why you don’t need to have your tax papers in order:

1. The dog ate my tax receipts

2. Convenient, unexplained, miscellaneous computer malfunction

3. Traded documents for five terrorists

4. Burned for warmth while lost in the Yukon

5. Left on table in Hillary’s Book Room

6. Received water damage in the trunk of Ted Kennedy’s car

7. Forgot in gun case sold to Mexican drug lords

8. Forced to recycle by municipal Green Czar

9. Was short on toilet paper while camping

10. At this point, what difference does it make?

The meat of his resolution is even more impressive in that many of these excuses are taken from other cases brought before Congress and presented by government officials operating in their government capacities and royally screwing up!

This representative further addresses in all seriousness that whatever defense is allowable to government is allowable to civilians. Naturally, the political elite will not take his resolution seriously.

I think, in the end, Lew Rockwell STILL had it right: “Hey, folks. The IRS scandal is that they steal your money at the point of a gun — and doing more and more of it right now — not whether they give some conservative group a tax exemption.”

Singling out ideological groups for one thing or another is neither here nor there, since the government has institutionalized bigotry since its inception. Nor is the issue that they play favorites with the crumbs from the table, but rather that we are left to settle for crumbs in the first place.

I remember Thomas Sowell making an argument about Obamacare that likewise extends to all services for which we rely on government’s monopoly. He said something to the effect of: people can’t afford healthcare now, so we are going to make them pay into the system, add a layer of bureaucracy, and that will make healthcare more affordable?

Laughable, right?

In any case, with FATCA and Obamacare slowly coming into effect, the US economy operating on imagination and fumes, and the IRS trying to get their hands on every last dime come hook or by crook, taxation is not reserved for the “uber rich” as the liberals might contend. The inevitable group that will get caught in the crosshairs are the remaining albeit dwindling middle class. The good news is, just as taxation isn’t reserved for the uber rich, neither is asset protection. There are some great options out there for those of you who have busted your hump and played by the rules. The rules can still work in your favor. Call for a consultation today.