December 29, 2015

By: Kelly Diamond, Publisher

What a year! This is my last installment for the year 2014. The next time you see my writing, it will be 2015.

What a year! This is my last installment for the year 2014. The next time you see my writing, it will be 2015.

Without question, the United States has lost its economic luster, but so have parts of the EU and Asia. Yet, there are countries who have chosen to see this as an opportunity to compete and revitalize their economies. The same can be said for individuals: while some still put their faith in the fiat currency of the US or put all their eggs into one IRS coded retirement plan, there are others who are diversifying and globalizing their assets based on the warning signs and trends they see.

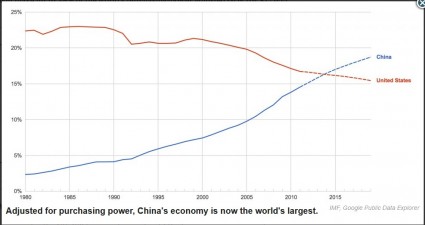

We’ve seen a few things happen over this year. There is of course the slow roll out of Obamacare, the peaks and valleys of the EU and its various constituents, the Chinese making a surprising burst in the last lap of 2014 to beat out the US on nearly every front but raw GDP, and Russia and Japan flailing about monetarily to name just a few.

So, going into the new year, what is the prognosis? Well, I think if Hong Kong and Estonia just stayed their course and didn’t change a thing, they would still be poised for economic gains. There are murmurs of Hong Kong adopting a sales tax… but not in the near future given the cultural and legal hurdles entailed in such an endeavor. Come next year, I will be monitoring Hong Kong and Estonia’s standings in worldwide economic freedom.

As for China, we have not seen the last of the great dragon. If anything, their resolve just kicked into overdrive. The press coverage of China’s economic gains, especially pitted against the US means not just a happy new YEAR for China, but a happy new GEAR as well. They have always played the long game. I don’t expect any sloppy play from them next year whatsoever, but I do expect some new benchmarks and more shaming of the U.S.

One of the things we are losing to China, as is the EU, is lending power. Several countries are looking to China for no other reason than to avoid the US and her allies. And who could blame them? Dare I call this the closest we’ve seen of free market anarchism in our lifetimes? There is no “world government” (yet) that dictates how each country engages in commerce with another country… and China just stepped up as the latest and greatest benefactor for countries such as Argentina, Russia, and Venezuela. It all but hip-checked Japan to the curb as being the largest benefactor to the Asian Infrastructure Investment Bank.

The EU is a tough call. I look at countries like Estonia and Ireland and I get hopeful. Then I see how the EU frowns upon rugged competition (for instance how it put the kibosh on the Double Irish), and wonder if it will even allow its struggling members to scrape out of their respective economic holes. My eye will be on Germany, and how it shoulders the crumbling areas of the EU economy. My eye will also be on Switzerland, Austria, and Luxembourg and how they field the U.S. FATCA policies, or if Americans will just be black listed from their banks altogether to spare them the hassle?

Russia has issues. Long standing issues that are deeply seated in cronyism. I don’t see that changing, but I will be watching their relationship with China, and the energy markets for sure in 2015.

2015 is the year when the ACA mandate chickens come home to roost. Up to now, we’ve seen a few things happen under the Affordable Care Act:

- People have lost the policies they were assured they could keep. Obama made an exception after some bipartisan pressure, but only some of the states actually applied that exception, and of the ones that did apply it, the premiums went up. (Apparently, Obama only promised they could keep their plan, not the premiums of those plans.)

- When people went back to get the new government approved plans, there were winners and losers. Some people’s premiums went up, some went down thanks to the subsidies provided at the expense of the former.

- The premiums went up on a considerable amount of people and are projected to go up even further (in the double digit percentiles) next year.

- More people have been put on Medicaid (the state level socialized medical insurance plan).

- The states are struggling to keep up with the subsidies. After all, Obamacare was a federal law that put the burden on individuals and states to work out. (Check out what’s happening in Minnesota. Look at what other states are doing to make up for the costs.)

- Whether the premiums went up or not, the networks are smaller, and are putting an undue burden on individuals who have to find in-network care often hours away from where they live.

- Many rural hospitals have closed down due to cuts in federal funding and imposition of new federal mandates.

- There was the rollout of healthcare.gov that went off with several hitches.

Earlier this year, two judges ruled to defund Obamacare (Woops!):

“Their opinion relies on seven words in the Obamacare statute — ‘through an Exchange established by the State’ — which, if read out of context, suggest that the tax credits are not available in up to three dozen states where health exchanges are run by the federal government.” Source: Think Progress (I know! Slanted as this source is, the ruling did happen, and it was in fact predicated on these seven words.)

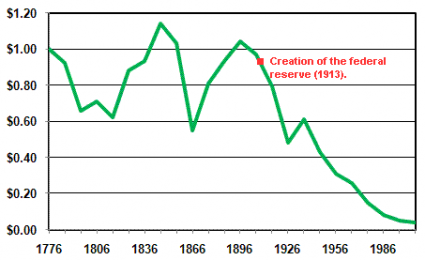

So while nearly one fifth of the U.S. economy looks like it’s going to hell in a hand basket, and one fifth of junk bonds is tied up in energy which is also taking a beating, the US dollar looks untouched. Or at least to the average evolutionary dead end who believes all’s well. US purchasing power is lost to China and/or the Fed (you choose, both are correct):

I realize that a lot of what I cover can be seen as gloom and doom. My articles are little weekly warning signs on your path of life. And what do we do when we see warning signs? Panic? Certainly not. Some pull off the road for a bit to look for all the alternate routes. Others tough it out and stay their course, but are braced for the rough patches. But the journey doesn’t stop, does it?

Have a safe and joyous New Year! May your resolve and vigilance grow stronger, and here’s to all the detours that will lead you and yours to enjoy even more freedom!